We specialise in serving headquarters of global brands, helping them cut complexity costs in strategy execution across markets and fulfil their corporate role as scale economisers and advantage accelerators. Leverage our consulting expertise, technology solutions and remote talent resources to create organisational simplicity, scalability and efficiency in multi-market operations.

Transforming global brand marketing, creative and eCommerce function into a competitive advantage

(EMEA) 14 markets

(EMEA) 14 markets

(EMEA) 47 markets

(EMEA) 47 markets

(EMEA) 17 markets

(EMEA) 17 markets

(WHQ)

(WHQ)

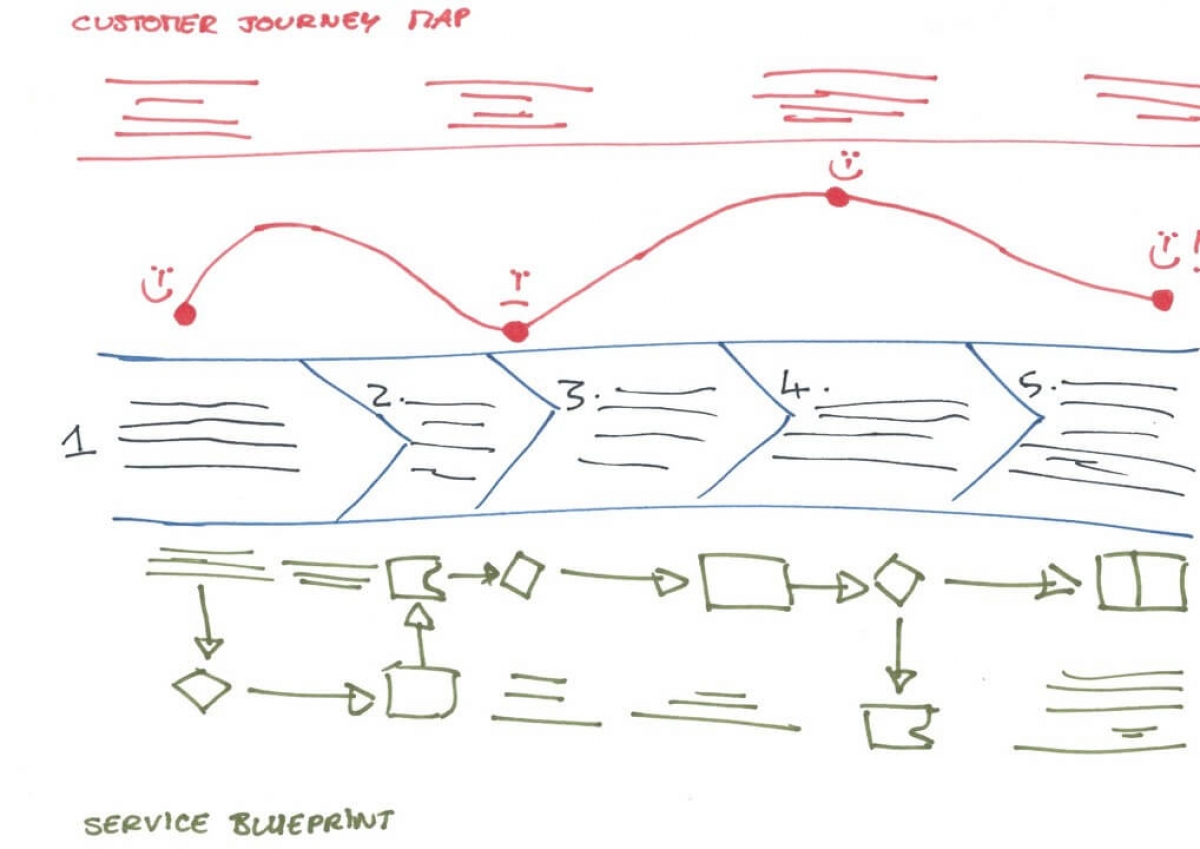

A customer journey map is a very simple idea: a diagram that illustrates the steps your customer(s) go through in engaging with your company, whether it be a product, an online experience, retail experience, or a service, or any combination. The more touchpoints you have, the more complicated — but necessary — such a map becomes. Sometimes customer journey maps are “cradle to grave,” looking at the entire arc of engagement. (HBR, A.Richardson).

So basically, a customer' journey defines where your customer starts and how he ends up with you. For example alot of customer journeys start at Google.com (with Search), some, like when you're in a foreign city and trying to find a place for drinks some will start with a Google Maps and lately when you need to shop many customer journeys start with and on Amazon.com (which Google doesn't like much). More and more people are changing habits and starting their journeys digitally - via online / digital /devices. In this one has to understand that all companies and all brands are actually "Competing on Digital Customer Journeys". If one takes into account the Digital Growth Potential for Retail Brands (and majority of all Brands) how successfully you compete on digital customer journeys becomes an essential element whether sales go your way or your competitor's way. If one takes into account that through digital sales you're also acquiring your customer's data, that means that a victory today also makes a big importance for tomorrow.

Industry Structure and Nature of Competition

A Category / Industry membership pretty much defines and influences significantly the way you compete. For example, if you're a Luxury Brand you will compete more on image and brand than say on price and volume. Same, if you're a performance sports brand you will compete on performance elements of products and innovation around those. If you're an Airline you're most probably be competing on price and lines as service levels are pretty much regulated. If you're an agency / creative / marketing / digital you're probably competing on creativity - entering festivals to win prizes etc. You get the point.

Digital Re-Construction Customer Journeys and Nature of Competition

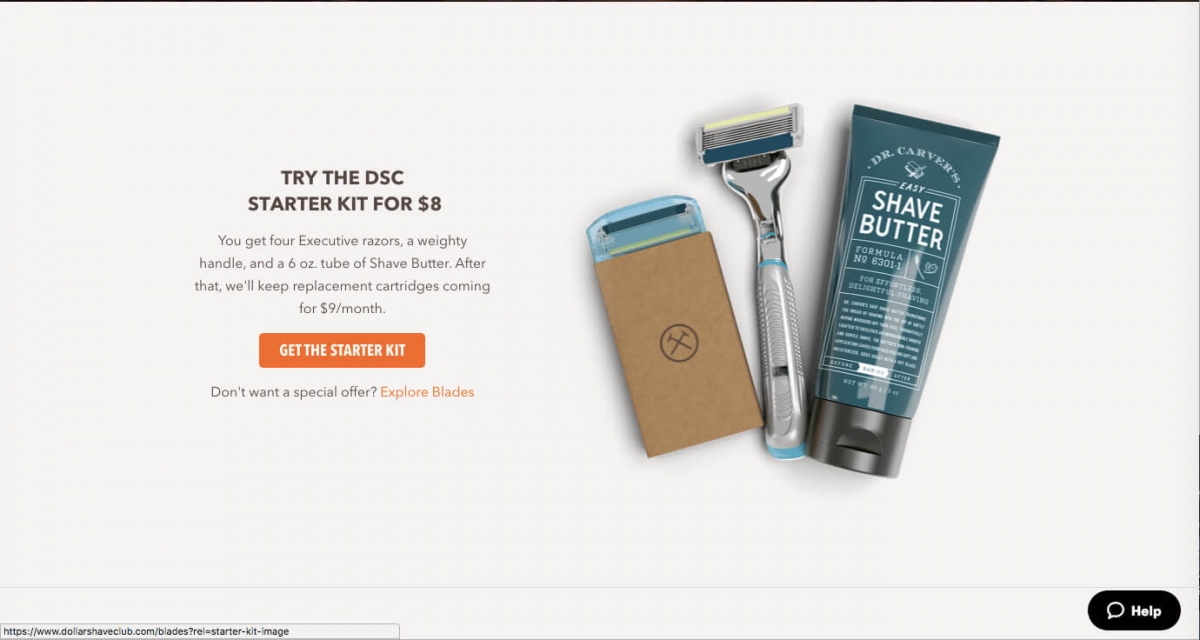

How does Digital change, re-construct the nature of competition. At the moment there aren't a lot of examples of this, but some signals are there. For example, I wrote that while most of Brands are looking to their traditional channels and trying to outcompete each other for example on retail shelves or e-commerce / marketplace engines Digital enabled competitors might think of other strategies. For example, compete on delivery / distribution rather than on brand / image / availability on certain/ existing marketplace (online or offline). Take a look at the DollarShave Club.

While most Brands are looking to their traditional channels and trying to outcompete each other for example on retail shelves or e-commerce / marketplace engines, Digital enabled competitors might think of other strategies. For example, compete on delivery / distribution rather than on brand / image / availability on certain/ existing marketplace (online or offline).DollarShave Club and Re-Construction of a Customer Journey

DollarShave club shifted the competition plain, the consumer journey and it is a great example of "Servizicing of Brands". Traditional competition was being done in traditional retail where P&G dominates with its scale, premium positioning and availability. Unilever and P&G are masters at traditional marketing, mostly offline, but they struggle with the direct-to-consumer brand-building at which upstarts like Dollar Shave Club excel. That is why, Unilever bought Dollar Shave Club for 1 billion. In this case consumer journey for razor blades has been permanently changed but also, dreadfully, brands (and all of the investment they made throughout years) have been deleted from this customer journey. Why? Well because, consumers started trading in brands (and their presence in traditional stores - and traditional customer journey) over a new customer journey which starts with convenience (delivery, handling etc).

In this case consumer journey for razor blades has been permanently changed but also, dreadfully, brands (and all of the investment they made throughout years) have been deleted from this customer journey.

Subscribing to a monthly supply Razor (Kits). Delivered to your door. No hassle.

Article Below

Boris Ziegler

Boris Ziegler